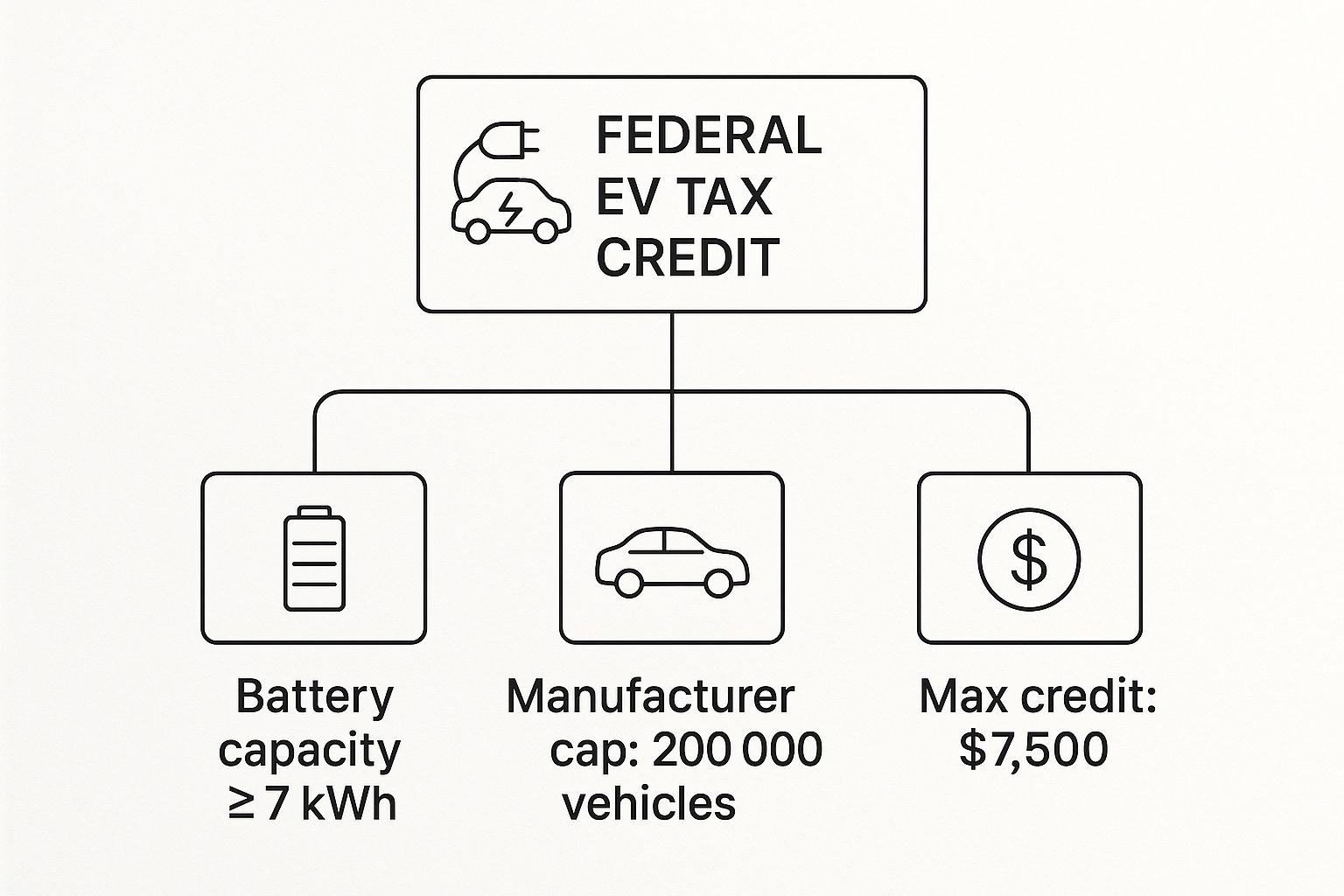

Thinking about buying an electric car? One of the biggest perks you'll hear about is the EV tax credit. In simple terms, it's a government incentive designed to knock a significant chunk off the price, making it easier for you to switch to a cleaner vehicle.

The big one is the federal credit, which can save you up to $7,500 on a new EV. And thanks to some recent changes, you might not even have to wait until tax season to see those savings. Some dealerships can now apply it right at the point of sale.

So, How Do EV Tax Credits Actually Work?

It can sound a little complicated, but the goal is straightforward: the government wants more people driving electric. To make that happen, they're offering these financial incentives to make EVs a more attractive and affordable option for everyday drivers.

Don't mistake these credits for a small coupon. They're a game-changer that can significantly lower the upfront cost, often making the difference in whether someone can afford to go electric. The main federal program, the Clean Vehicle Credit, is a powerful tool to bring that sticker price down.

Two Ways to Get Your Money

It used to be that you had to buy your EV, then wait until you filed your taxes the next year to claim the credit. That's still an option, but a newer, much faster method has made things a lot simpler.

You now have two ways to claim your credit:

- Instant Rebate at the Dealership: This is the big one. If you're buying from a registered dealer, you can transfer the credit to them directly. They'll apply the full amount to the purchase price right then and there, lowering what you pay out of pocket. It’s like getting an instant discount on the spot.

- Claim it on Your Taxes: The traditional route is still available. You can claim the credit when you file your annual federal income tax return. This will reduce the total amount of tax you owe for the year, which could mean a smaller tax bill or a bigger refund.

This flexibility is great because it lets you pick what works best for your budget. Need to lower the monthly payment? Take the savings upfront. Prefer a bigger tax refund? Wait and file.

At its heart, an EV tax credit is a dollar-for-dollar reduction in what you owe in federal taxes. If you qualify for a $7,500 credit and owe $8,000 in taxes, your tax bill drops to just $500.

What Determines if You Qualify?

Unfortunately, not every car or buyer is eligible. There are a few key rules you need to meet, and they mostly boil down to your income, the car's price, and—this is a big one—where the car and its battery parts were made.

The government has put a heavy emphasis on boosting U.S. manufacturing, and the tax credit rules reflect that. This push has had a huge impact, with over 7 million electric and plug-in hybrid vehicles sold since the credit began and recent sales topping 1.5 million per year.

Getting a handle on these rules is your first step to saving thousands. To really understand the financial advantages of EV ownership, you'll want to look at the whole picture. For a deeper dive, check out our complete https://solanaev.com/electric-vehicle-cost-comparison/ to see how it all adds up.

Qualifying for the Federal Clean Vehicle Credit

Navigating the federal EV tax credit can feel a bit like putting together a puzzle. It’s not just about buying an electric car; it’s about making sure you, the car, and even its battery parts all fit the specific rules. Think of it as a three-part checklist: your personal eligibility, the car's price and specs, and some surprisingly complex manufacturing requirements.

Let's walk through each piece so you can see exactly where you and your potential new EV stand.

Your Income: The First Hurdle

First things first, this credit is targeted at middle-income buyers. The government sets a hard cap on how much you can earn and still qualify. Your Modified Adjusted Gross Income (MAGI) can't be higher than these limits in either the year you buy the car or the year before.

- $300,000 for married couples filing a joint tax return

- $225,000 for heads of households

- $150,000 for all other individual filers

This two-year window is a nice bit of flexibility. For instance, if you got a big promotion this year that pushes you over the limit, you can still claim the credit as long as your income from last year was under the cap.

The Vehicle Itself: Price and Type Matter

Next up, the car has to meet its own set of rules, and the big one is the price tag. The Manufacturer's Suggested Retail Price (MSRP)—what you see on the window sticker—can't go over a certain amount.

This isn't about penalizing luxury; it's about making everyday EVs more affordable for more people. The caps are based on the type of vehicle:

- $80,000 for SUVs, vans, and pickup trucks

- $55,000 for other vehicles, like sedans and hatchbacks

Remember, the MSRP that counts is the one from the manufacturer, including factory-installed options. It doesn't include things like dealer markups, taxes, or destination fees. For a deeper dive into all the costs involved, our electric vehicle buying guide can help you get the full picture.

The Tricky Part: Where Was It Made?

This is where things get really specific. To boost American manufacturing, the full $7,500 credit is split into two halves, each worth $3,750, and both are tied to the battery's origins and the car's assembly location.

A car might qualify for one part, both, or neither.

- Critical Minerals ($3,750): A growing percentage of the critical minerals in the battery (think lithium and cobalt) must come from the U.S. or a country we have a free trade agreement with.

- Battery Components ($3,750): A certain percentage of the battery's components must be manufactured or assembled right here in North America.

These rules are designed to get tougher over time, pushing carmakers to bring more of their supply chains closer to home. It’s a major reason why the list of eligible vehicles can seem a bit unpredictable. You might see a foreign brand that qualifies because it's built in a U.S. factory, while an American brand might not if its battery parts come from the wrong place.

To simplify this, here's a quick checklist that breaks down the key requirements for both new and used vehicles.

Federal Clean Vehicle Tax Credit Eligibility Checklist

| Requirement Category | New Clean Vehicle Credit Details | Used Clean Vehicle Credit Details |

|---|---|---|

| Buyer Income (MAGI) | Under $150k (single), $225k (head of household), $300k (joint) | Under $75k (single), $112.5k (head of household), $150k (joint) |

| Vehicle Price Cap | Under $80k (SUVs/Trucks/Vans) or $55k (other vehicles) | Under $25,000 |

| Vehicle Age | Must be a new vehicle | Model year must be at least 2 years older than the current year |

| Purchase Source | From a licensed dealer | From a licensed dealer |

| Assembly/Sourcing | Final assembly in North America; meets battery/mineral rules | No sourcing rules apply |

As you can see, the rules are different depending on whether you're buying new or used. The most important takeaway for a new EV?

The final assembly location is a deal-breaker. To qualify for any part of the new vehicle credit, the car must have its final assembly in North America.

Because the sourcing rules and eligible vehicle lists are constantly changing, it's absolutely essential to double-check a car's status before you buy. The official government source at FuelEconomy.gov is always the most up-to-date place to look.

So, How Do You Actually Get Your EV Tax Credit?

Alright, you've done the hard work. You've confirmed that you and your shiny new EV both qualify for the federal tax credit. Now for the most important part: how do you get that money in your pocket?

Thankfully, the process is more flexible than ever. You now have two distinct paths to claim your savings. You can either get an instant discount right at the dealership or go the traditional route and claim it on your annual tax return. Let's walk through how each one works so you can decide which is right for you.

Option 1: The Instant Rebate at the Dealership

This is the newer, and for many people, the better option. Instead of waiting until tax season, you can now transfer your credit directly to the dealer when you buy the car.

Think of it as a $7,500 coupon you can use on the spot. The dealer applies the full credit value directly to the price of the car, instantly lowering the amount you need to pay or finance. This makes the vehicle more affordable from day one, which is a huge win.

Here’s the simple breakdown of how it works:

- First, make sure you’re buying from a dealer registered with the IRS Energy Credits Online portal.

- When you're doing the paperwork, you'll sign a form with the dealer to confirm you're eligible and agree to transfer the credit to them.

- The dealer handles the rest, submitting the info to the IRS and knocking the credit amount right off your bill.

This point-of-sale option is a game-changer, especially if you don't typically owe a lot in federal taxes. You get the full benefit of the credit no matter what.

Option 2: Claiming the Credit on Your Tax Return

The old-school way of claiming the EV credit is still an option. This involves waiting until you file your federal income taxes for the year you bought the car.

It requires a little more patience, but it's a straightforward process. You'll need to fill out and attach IRS Form 8936, "Clean Vehicle Credits," to your regular tax return.

The catch here is that this is a non-refundable tax credit. That means it can reduce what you owe the IRS down to zero, but you won't get any leftover amount back as a cash refund.

Let’s say you qualify for the full $7,500 credit, but your total tax liability for the year is only $5,000. The credit will wipe out your tax bill, which is great, but the remaining $2,500 of the credit simply disappears. This is a critical detail and a major reason why the upfront dealer rebate has become so popular.

Comparing Your Two Options

So, which path should you take? It really boils down to your personal finances. The instant rebate gives you immediate savings and simplifies your purchase, while the tax return method is perfectly fine for those who have a big enough tax bill to absorb the full credit and don't mind the wait.

Here’s a quick side-by-side to help you decide:

| Feature | Point-of-Sale Rebate | Filing with Tax Return |

|---|---|---|

| Timing of Benefit | Immediate, right when you buy the car | Delayed, when you file your taxes the following year |

| How It Works | Reduces the vehicle's purchase price directly | Reduces your total federal tax bill |

| Key Requirement | The dealer must be registered with the IRS | You must owe enough in taxes to use the credit |

| Best For | Buyers who want lower upfront costs or have a low federal tax bill | Buyers with a high tax bill who want a smaller tax payment |

Ultimately, both roads lead to the same destination: making your new EV more affordable. By understanding these two choices, you can make the smart call that best fits your financial situation.

Finding State and Local EV Incentives

The $7,500 federal tax credit gets all the headlines, but it’s really just the starting point. Think of it as the base layer of your savings cake. The real magic happens when you start stacking state and local incentives on top.

This is where you can unlock some serious savings. These programs are tailored to your specific area, often with unique perks you won't find anywhere else. It’s absolutely worth a little digging to see what your state, county, or even your local utility company is offering.

What Kinds of State and Local Incentives Exist?

While the federal government offers a single, well-known tax credit, state and local programs are a lot more varied. This variety is great for buyers, as it opens up multiple ways to save money—not just when you buy your EV, but throughout your ownership.

You'll generally find these incentives fall into a few common categories:

- Cash-Back Rebates: This is the most straightforward perk—a check in the mail. States like California have programs that send you money after you’ve purchased a qualifying EV.

- State Tax Credits: These work just like the federal credit but apply to your state income taxes. Colorado is a great example, offering a hefty credit that significantly lowers your tax bill.

- Charging Infrastructure Rebates: Getting a home charger installed can be a big expense. Many local utility companies know this and offer hundreds of dollars in rebates to ease the financial sting.

- Non-Monetary Perks: Sometimes the best benefits aren't about cash. Think about getting access to the HOV or carpool lane during rush hour, paying lower vehicle registration fees, or even getting free parking. These can be incredibly valuable.

By combining a $7,500 federal tax credit with a $2,500 state rebate and a $500 utility credit for a home charger, a buyer could potentially save $10,500 or more on their total cost.

Real-World Examples of State Programs

To get a better sense of how this all plays out, let's look at a couple of states with standout programs. Each one takes a slightly different approach, which really highlights the diversity of these incentives.

Colorado's Aggressive Tax Credit

Colorado has one of the most generous state tax credits in the nation. It's designed to make EVs more accessible by directly cutting down what you owe in state taxes. The exact amount has shifted over the years, but it remains a powerful incentive for Colorado residents.

California's Rebate Projects

California has been at the forefront of the EV movement for years, and it shows in its programs. The state offers direct cash-back rebates for buying an EV and also invests heavily in building out the charging network. To see how these initiatives work, you can explore programs like California's CALeVIP 2.0 Incentive, which is all about expanding public charging options.

How to Find Incentives in Your Area

With incentives scattered across different states, counties, and utility districts, figuring out what you qualify for can feel like a scavenger hunt. Luckily, there are a few simple ways to track them all down.

Your best bet is to start with your state's Department of Energy or Environmental Protection website. They almost always have a page dedicated to clean transportation incentives. Next, check with your local electric utility—they’re the ones who offer those valuable charger rebates. For a full rundown on getting your home ready, our guide to electric vehicle charging infrastructure covers everything you need to know.

To give you an idea of the variety out there, here's a quick look at what a few states offer.

Snapshot of State-Level EV Incentive Programs

The table below provides a glimpse into the diverse landscape of EV incentives across the United States. It's not an exhaustive list, but it highlights how different states are encouraging residents to make the switch to electric.

| State | Incentive Type | Maximum Value | Key Eligibility Note |

|---|---|---|---|

| California | Cash Rebate | Varies by Program | Often has income and vehicle price caps. |

| Colorado | State Tax Credit | Up to $5,000 | Based on vehicle purchase date. |

| New York | Point-of-Sale Rebate | Up to $2,000 | Applied directly at the dealership. |

| Various | Utility Charger Rebate | $250 – $1,000+ | Varies by electricity provider. |

Remember, these state and local programs are designed to work in tandem with the federal credit. Taking the time to research them is one of the smartest things you can do to make your new EV as affordable as possible.

How Global EV Incentives Compare to the US

The United States is far from the only country offering perks for buying an electric vehicle, but its strategy is pretty unique on the world stage. While most nations just want to get more EVs on their roads, the U.S. has a dual mission: boosting EV adoption and supercharging its domestic manufacturing and supply chains.

Think of it this way: the U.S. incentive is a carefully crafted tool with specific economic and environmental goals baked right in. Many other countries, especially in Europe, have historically gone for a more straightforward approach by offering simple, direct grants to get people into EVs as fast as possible. This global context really helps explain why the U.S. rules are so particular about where a car is built and where its battery parts come from.

Europe's Diverse Incentive Landscape

Head across the Atlantic, and you'll find a real patchwork of different EV strategies. There’s no single, unified policy in Europe; instead, each country is navigating the EV transition in its own way. Just about every European nation offers some kind of financial support, but the size and style of that support can vary wildly.

For example, 19 EU countries have rolled out tax breaks specifically for electric company cars, a smart way to get businesses to update their fleets. You can dig into the details if you'd like to learn more about Europe's EV incentive policies on acea.auto.

A few common approaches you'll see in Europe include:

- Direct Purchase Grants: Countries like Germany and France have offered big cash grants that slash the vehicle's sticker price right at the dealership. It’s a simple and effective way to get a buyer's attention.

- Ownership Tax Exemptions: In places like Norway—a long-time leader in EV adoption—owners have enjoyed massive savings by being exempt from hefty taxes like VAT (Value Added Tax) and annual road fees. This makes the total cost of owning an EV incredibly low.

- Focus on Infrastructure: Some nations are now pivoting, shifting money away from individual car rebates and pouring it into building out robust public charging networks. The goal here is to tackle range anxiety head-on for everyone.

Contrasting Global Philosophies

At the heart of it all is a difference in philosophy. A direct cash grant is a fantastic way to spike sales figures quickly. The U.S. model, however, is playing a longer game, aiming for a lasting impact on its industrial foundation. The American EV tax credits aren't just designed to sell cars this year; they're meant to ensure the cars of tomorrow are built with American hands and resources.

This focus on domestic production is the key differentiator. The US links its $7,500 credit to strict manufacturing and sourcing rules, a strategy not commonly seen in the direct-to-consumer grants offered by many other countries.

This look around the globe shows there’s no single "best" way to spur EV adoption. Every country designs its incentives around its own economic priorities and climate goals. By understanding these different playbooks, it becomes much clearer why the U.S. has chosen its specific path—weaving together consumer savings with a bold, strategic vision for its automotive future.

Your Top Questions About EV Tax Credits, Answered

Let's be honest, figuring out the rules for EV tax credits can feel like a maze. The details matter, and getting a straight answer is crucial before you decide to buy. We've tackled some of the most common questions we hear to give you clear, simple answers.

Think of this as your go-to cheat sheet for cutting through the confusion around how these incentives actually work.

I'm Leasing My EV – Do I Still Get the Credit?

This is a big one. When you lease, the leasing company is the legal owner of the car, so technically, the tax credit goes to them. But don't worry, you still benefit.

Most dealerships pass that $7,500 savings directly to you. You'll usually see it as a "lease credit" that lowers your down payment or shrinks your monthly payments. Always make a point to ask the dealer exactly how they're applying that federal incentive to your lease so you can see the savings on paper.

What if I Don't Owe Enough in Taxes to Use the Full Credit?

The federal EV tax credit is non-refundable. In simple terms, this means it can lower what you owe in taxes, but it can't give you a cash payout for any amount left over.

For example, if you qualify for the full $7,500 credit but your federal tax bill is only $4,000, the credit will erase your tax liability completely. You'll owe nothing. However, the remaining $3,500 of the credit simply disappears—you don't get it back as a refund.

This is exactly why the new point-of-sale rebate option is such a game-changer. It lets you get the entire credit as an immediate discount right at the dealership, sidestepping the whole tax liability issue.

How Can I Be 100% Sure a Car Qualifies?

Things like battery sourcing and manufacturing locations can change, which affects a car's eligibility. The only way to be certain is to check the official government sources.

Your best bet is the U.S. government's FuelEconomy.gov website, which keeps a running list of all eligible new and used clean vehicles. You can even check a specific car's VIN on an IRS portal. Don't just take a salesperson's word for it—a quick check on these sites gives you total peace of mind.

What if I Sell the Car? Do I Have to Pay the Credit Back?

For new vehicles, you're generally in the clear. If you sell the car later on, there's no rule that says you have to pay back the credit.

The rules are a bit stricter for used clean vehicle credits to prevent people from flipping cars for a quick profit. The main conditions are that you can't be the original owner and you can't have bought the vehicle with the sole intention of reselling it.

Ready to find a ride that's stylish, efficient, and good for the planet? Explore the premium lineup of street-legal electric vehicles at Solana EV and discover the perfect model for your lifestyle.