Commercial golf cart insurance is a specific type of policy built to protect businesses that use golf carts for work. It’s not just for the fairway anymore. This coverage steps in to handle liability risks and physical damage that your standard homeowners or personal auto policy will flat-out refuse to cover, protecting your business from potentially devastating claims.

Why Your Business Needs Commercial Golf Cart Insurance

Think of it this way: commercial golf cart insurance is like a heavy-duty commercial truck policy, but perfectly sized for your fleet of utility vehicles. If you're using a golf cart for anything beyond a joyride—transporting hotel guests, hauling maintenance gear across a university campus, or making security rounds—your personal insurance is no longer in the game.

The second a golf cart starts earning its keep as part of your business, the entire risk profile changes. A fender bender isn't just a personal headache; it’s a lawsuit waiting to happen to your company. That distinction is everything, because insurers draw a very clear, firm line between personal and commercial use.

The Growing Need for Commercial Coverage

Golf carts are showing up for work in more places than ever before. We're seeing them everywhere from airport tarmacs and sprawling industrial parks to master-planned communities, where they've become indispensable workhorses.

This isn't just a gut feeling; the numbers back it up. The global golf cart market was valued at around USD 1.71 billion in 2024 and is on track to hit USD 2.41 billion by 2032. As these vehicles become more common in the workplace, the need for the right kind of insurance becomes absolutely critical.

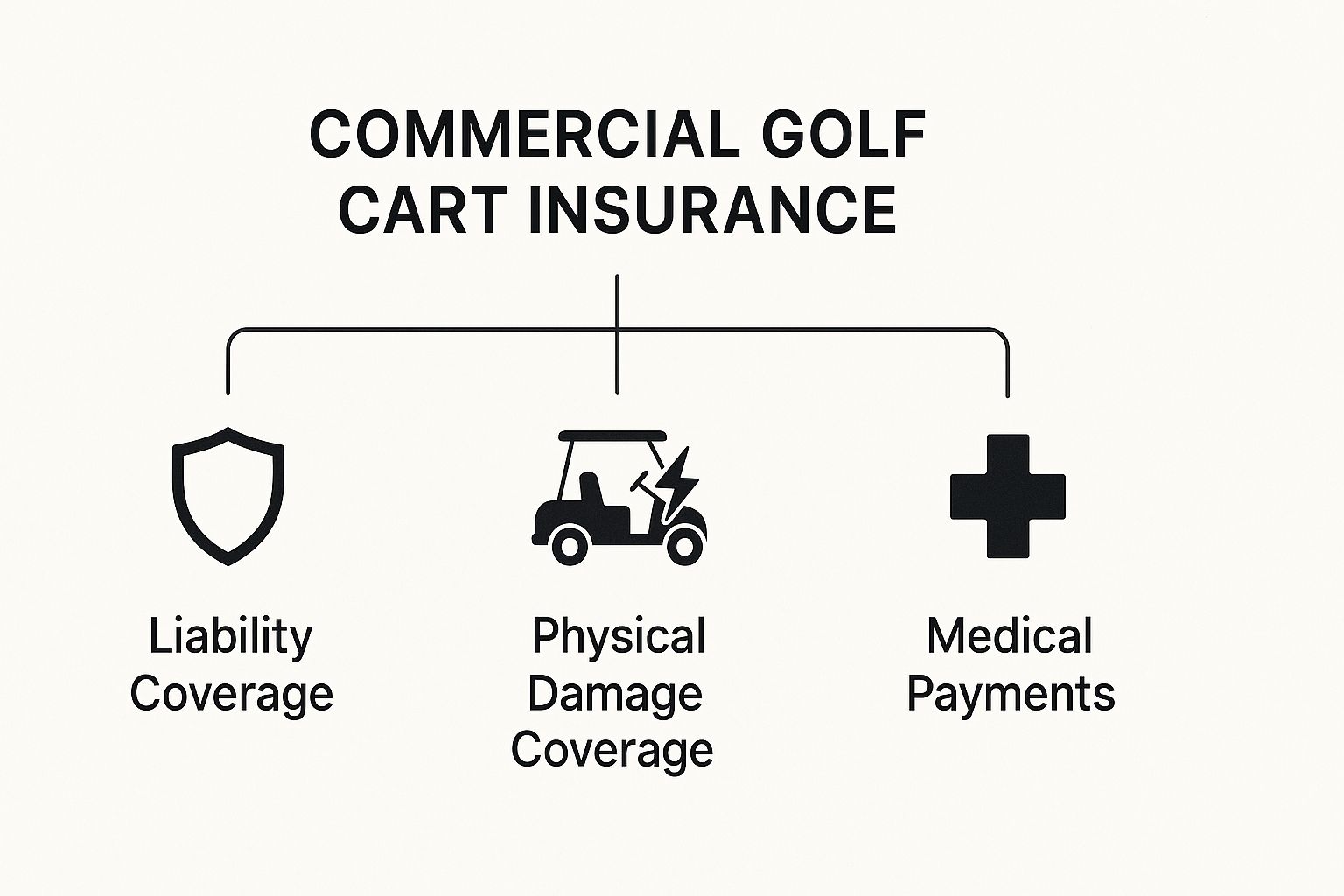

This visual gives you a clear look at what a solid commercial policy is made of.

As you can see, a strong policy rests on three key pillars—liability, physical damage, and medical payments. Each one is designed to tackle a different kind of risk you face every day.

How Commercial Policies Differ From Personal Ones

The biggest difference boils down to the sheer scope of protection. A personal policy is built for one person and their family's risk. A commercial policy, on the other hand, is engineered to shield a business's entire operation and its assets from much, much larger liabilities.

The heart of the matter is that a business cart is used more often, driven by more people (your employees), and interacts with the public far more frequently. Each of these factors cranks up the potential for an accident.

To really see the difference, it helps to compare them side-by-side.

Personal vs Commercial Golf Cart Insurance at a Glance

This table breaks down the fundamental distinctions between the two types of policies.

| Feature | Personal Golf Cart Insurance | Commercial Golf Cart Insurance |

|---|---|---|

| Primary Purpose | Covers recreational use for an individual or family. | Protects a business from liability during work-related activities. |

| Liability Limits | Lower, typically matching a homeowner's or auto policy. | Significantly higher, often starting at $1 million or more. |

| Covered Drivers | Policyholder and specified family members. | Employees and designated operators using carts for business tasks. |

| Vehicle Use | Personal leisure, driving around a neighborhood or on a course. | Transporting guests, hauling materials, security patrols, etc. |

| Fleet Coverage | Typically covers only one or two specified carts. | Can cover an entire fleet of vehicles under a single policy. |

As you can see, trying to protect your business with a personal policy is like using a garden hose to put out a warehouse fire—it's just not the right tool for the job.

Beyond insurance, proper training is a huge part of managing your risk. Putting your team through a solid https://solanaev.com/golf-cart-safety-training/ program can stop accidents before they even have a chance to happen. If you want to zoom out and see the bigger picture of business vehicle coverage, it can be helpful to look at general resources like this piece on insurance information for commercial-use vehicles. Seeing the parallels makes it crystal clear why specialized insurance is a must-have for any vehicle used for work.

Core Coverages Your Business Needs

Stepping into the world of commercial golf cart insurance can feel a bit overwhelming. You'll hear terms like "liability" and "comprehensive" thrown around, but what do they actually mean when one of your employees makes a wrong turn on the property? Let's cut through the jargon and look at what you truly need.

Think of these coverages as different tools in a safety kit. Each one is built to handle a very specific type of problem, making sure your business isn't left on the hook when an accident happens. Without the right protection, one bad day could turn into a massive financial headache.

Liability Coverage: Your First Line of Defense

Liability coverage is the bedrock of any commercial golf cart policy. Plain and simple, it protects your business assets if one of your carts hurts someone or damages their property. This is usually broken down into two crucial parts.

- Bodily Injury Liability: This is the big one. It steps in to pay for medical bills, legal fees, and potential court settlements if a person is injured in an accident involving your company’s golf cart.

- Property Damage Liability: This handles the costs to repair or replace someone else's property that your cart damages—think cars, fences, landscaping, you name it.

Let's make this real. Imagine a maintenance worker at your university is driving a cart and accidentally backs into a visiting professor's brand-new car. Property Damage Liability would cover the repair bill for the professor's vehicle.

Now, picture a guest at your resort being shuttled to their room. The driver takes a corner too fast, the passenger tumbles out and breaks an arm. That's where Bodily Injury Liability comes in, covering their medical expenses and any legal claims that might follow.

Liability isn't optional; it's essential. A single serious injury claim can easily cost more than your entire fleet of golf carts is worth. This coverage is the most important piece of your financial safety net.

Protecting Your Carts Themselves

While liability protects you from claims made by others, you also have to protect your own assets. Your fleet of golf carts is a significant investment, after all. That’s where physical damage coverage comes in, which also has two key components.

Collision Coverage

This one is pretty straightforward. It pays to repair or replace your golf cart if it’s damaged in a collision with another object, whether that's another vehicle, a building, a light post, or even if it just flips over.

For instance, if an employee is navigating a crowded event and misjudges a turn, smacking into a concrete pillar, Collision coverage would foot the bill to get your cart fixed. It’s worth noting that the choice between an https://solanaev.com/electric-or-gas-golf-cart/ can sometimes affect repair costs and complexity, something fleet managers should keep in mind.

Comprehensive Coverage

This is your protection for almost everything else—the kind of non-collision curveballs that life can throw at you. It’s a shield against unpredictable events that aren't a typical crash.

Think of it as your "what if" coverage. Here are a few things it typically handles:

- Theft: One of your carts is stolen from a storage shed overnight.

- Vandalism: Someone decides to intentionally damage your carts parked on the grounds.

- Fire: An electrical fire in your maintenance garage damages several of your vehicles.

- Weather Events: A nasty hailstorm leaves dents all over your fleet, or a heavy branch falls and crushes a cart during a thunderstorm.

Years ago, golf cart insurance was a simple product designed for courses. But as carts started showing up everywhere—from sprawling corporate campuses to massive resorts—the risks grew. By 2018, with over 500,000 commercial carts in use across North America, insurers had to evolve. Policies were expanded to cover this much wider range of real-world, non-collision scenarios that businesses now face every day.

How Your Insurance Premium Is Calculated

Ever wonder how an insurance company lands on a specific number for your premium? It’s not just a shot in the dark. Insurers are essentially professional risk assessors, and they look at a whole host of factors to figure out the likelihood that you'll file a claim.

Think of it like calculating the shipping cost for a package. A small, light box going across town is pretty cheap to send. But a large, fragile crate being shipped across the country? That’s going to cost you a lot more. In the same way, a single golf cart used on a small private lot carries far less risk—and a lower premium—than a large fleet zipping around a busy public area.

Let's break down the key ingredients that go into that final price.

Fleet Size and Vehicle Value

This is the most obvious starting point. The more carts you have, the more you can expect to pay. It’s a simple numbers game: insuring 20 carts will naturally cost more than insuring just two because each additional vehicle represents another potential accident waiting to happen.

But it’s not just about quantity; quality matters, too. A fleet of brand-new, high-end electric carts loaded with custom features will have a higher premium than a handful of older, basic models. Why? Because the cost to repair or replace them after a crash or theft is significantly higher.

Operational Use and Environment

How and where you use your carts is a huge piece of the puzzle for an underwriter. They’ll want to know exactly what your carts do all day because some activities are just plain riskier than others.

- Low-Risk Use: Think of a maintenance crew using carts on a private, fenced-in industrial campus after hours. Very little can go wrong there.

- Moderate-Risk Use: This might be a fleet that shuttles guests around a contained resort property on clearly marked, designated paths.

- High-Risk Use: Now, picture a fleet of street-legal carts making deliveries on public roads with speed limits up to 35 mph. The potential for a serious accident is much, much higher.

The environment is just as crucial. A quiet, gated community with almost no traffic is a world away from a sprawling university campus or a busy airport tarmac, where carts have to navigate around pedestrians, cars, and other service vehicles. The more chaotic the setting, the higher the perceived risk.

Your premium is a direct reflection of your business's unique risk profile. An insurer's primary goal is to match the price of the policy to the probability and potential severity of a future claim.

Your Coverage Choices and Limits

Finally, the decisions you make when setting up your policy have a direct impact on your premium. This is where you have the most control, but it requires a careful balancing act between saving money and getting the protection you actually need.

Policy Limits

This is the absolute maximum amount your insurer will pay for a covered claim. A policy with a $500,000 liability limit will always be cheaper than one with a $2 million limit. Going for lower limits can feel like a smart way to save money, but it could leave your business dangerously exposed if a serious accident results in a lawsuit that exceeds your coverage.

Deductibles

Your deductible is the amount you agree to pay out-of-pocket on a physical damage claim before the insurance company pays a dime. If you have a $1,000 deductible and a cart needs $5,000 in repairs, you pay the first $1,000, and your insurer covers the remaining $4,000.

- A higher deductible means a lower monthly premium, but you'll have to shell out more cash if an accident happens.

- A lower deductible means a higher premium, but you'll have less of a financial hit when you need to file a claim.

Choosing the right mix comes down to knowing your business's finances. You need to find that sweet spot where your commercial golf cart insurance premium is manageable, but your deductible is an amount you could realistically pay on short notice without derailing your operations.

How to Find and Choose the Right Policy

Getting the right commercial golf cart insurance isn't just about ticking a box or finding the lowest price. It's about finding the smartest policy—one that acts as a genuine shield for your business when you need it most. The last thing you want is to discover a gaping hole in your coverage after an accident has already happened.

Finding that perfect fit requires a bit of a strategy, not a guessing game. And it all starts long before you even see a single quote.

First, Get a Handle on Your Real-World Risks

Before you can even think about shopping for a solution, you have to get crystal clear on the problem. In this case, that means identifying all the specific ways your golf carts could land your business in hot water financially. Think of this as an internal audit—it’s the foundation of a solid insurance plan.

Take a walk through your property and try to see it through an insurer's eyes. What could go wrong? Ask yourself some tough questions about how you actually operate day-to-day:

- Who's behind the wheel? Are your drivers seasoned employees with spotless records? Or do you have a high turnover of younger, less experienced operators?

- Where are the carts going? Do they stick to quiet, private paths on your property? Or are they crossing public streets and navigating through crowds of pedestrians?

- What's their job? Are they just hauling tools and equipment in a secure area? Or are they shuttling guests—including kids and elderly visitors—around your venue?

Every answer helps you build a detailed risk profile. A resort using carts to ferry wedding guests near a swimming pool has a completely different set of risks than a construction site using them to move materials. Knowing exactly where you're vulnerable is the crucial first step.

Get Your Paperwork in Order

Once you have a clear picture of your risks, it's time to gather your documents. Insurance agents need specific information to give you an accurate quote, and having everything ready to go will make the whole process faster and a lot less painful.

Think of it like putting together a resume for your business. The insurer needs the facts to make a good decision.

A clean, organized submission sends a strong signal to an insurer that you run a tight ship. This can sometimes even lead to better terms, simply because it suggests you're a lower-risk client.

You’ll want to have these items on hand:

- A Full Cart Inventory: Make a list of every single cart in your fleet, including the make, model, year, and its Vehicle Identification Number (VIN).

- Driver Details: Have a list of all employees who will be driving the carts, along with their driver's license numbers.

- How You Use Them: Write a clear description of what the carts do every day, the routes they typically take, and where they’re stored overnight.

- Claim History: Pull together a record of any vehicle-related claims your business has filed over the past three to five years.

Find an Agent Who Gets Your Business

Here’s a secret: not all insurance agents are the same. While pretty much anyone can sell you a standard car insurance policy, you need someone who truly understands the niche world of commercial golf cart insurance. A specialist will know the right questions to ask and, more importantly, which insurance companies have the best programs for your specific industry.

Your best bet is often an independent agent who works with multiple insurance carriers. This gives you way more options and ensures their loyalty is to you—not to a single company. When you talk to potential agents, ask them directly about their experience with businesses like yours, whether you run a resort, a university campus, or a massive logistics center.

Compare Quotes the Smart Way

When the quotes finally land in your inbox, fight the urge to just scan for the lowest number. The cheapest policy is often cheap for a reason—it’s usually the one with the biggest coverage gaps.

Instead, lay the proposals out side-by-side and compare them based on the actual value they offer. Look closely at these key details:

- Liability Limits: Are the limits the same on every quote? Or is one dangerously low?

- Deductibles: How much will you have to pay out of your own pocket before the insurance kicks in?

- What’s Actually Covered: Does one policy cover things (like theft of custom parts) that others specifically exclude?

- Endorsements & Add-Ons: Did one agent include a critical add-on for your custom equipment that another one missed entirely?

Choosing the right policy is a strategic business move. By taking the time to assess your risks, prepare your info, find a great agent, and compare quotes based on true value, you can lock in coverage that gives you real peace of mind.

Policy Exclusions and Smart Add-Ons

Knowing what your commercial golf cart insurance covers is only half the battle. The real key to protecting your business is understanding what it doesn't cover. Every policy comes with a set of limitations known as exclusions. Think of them as the hard-and-fast rules of your coverage—step outside them, and you’re on your own if something goes wrong.

But don't worry. Once you know where the gaps are, you can fill them. That’s where optional coverages, often called endorsements or add-ons, come into play. These are specialized upgrades that patch the holes in a standard policy, giving you a safety net built specifically for your business's real-world risks.

What Standard Policies Typically Leave Out

Insurance is there for the unexpected, not for deliberate acts or predictable aging. Because of this, you’ll find that most policies draw a firm line on a few specific situations. Getting familiar with these now can save you from a denied claim and a massive, unexpected bill down the road.

Here are a few of the most common exclusions:

- Intentional Damage: If an employee deliberately crashes a cart or uses it to damage property, insurance won't touch it. Coverage is for accidents, not malicious acts.

- Racing or Speed Contests: Using your carts for any kind of competitive race or timed event is a surefire way to void your coverage for any damage or injuries that occur.

- Wear and Tear: Insurance is designed to fix sudden and accidental damage, not to pay for the natural breakdown of parts over time. Things like worn-out tires or aging batteries are considered routine maintenance costs.

- Use in Unapproved Areas: If your policy is for on-premise use, driving a cart on a public road without the right endorsement could leave you completely unprotected in an accident.

Reading the fine print on exclusions isn't just a suggestion—it's essential. These are the rules that define the boundaries of your financial protection.

Smart Add-Ons to Fill the Gaps

This is where you can dial in your coverage. Optional endorsements let you buy back protection for specific risks, creating a policy that truly fits your day-to-day operations. These add-ons are designed to plug the exact holes that standard policies often leave open.

Custom Equipment Coverage

Have you upgraded your carts? Maybe you've added heavy-duty utility beds for your grounds crew or installed premium sound systems and comfortable seating for resort guest shuttles.

A basic policy will only cover the cart's factory value. So if that cart with $5,000 in custom upgrades gets totaled, you'll only be reimbursed for the stock model. Custom Equipment Coverage closes this gap, ensuring the full value of your investment—including all those modifications—is protected.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

This one is absolutely critical, especially if your carts operate anywhere near other vehicles. Let's say a delivery truck hits one of your carts on your property, injuring an employee. If the truck driver is uninsured or has minimal coverage, your business could be left holding the bag for medical bills and repair costs.

UM/UIM coverage is your defense against this. It steps in to cover your expenses when the at-fault driver can't, protecting you from the financial consequences of someone else's irresponsibility.

Rental Reimbursement Coverage

What happens if one of your key carts is in the shop for a week after an accident? For a maintenance team, that could mean major project delays. For a resort, it could mean a shuttle out of service during peak season.

Rental Reimbursement helps cover the cost of a temporary rental cart while yours is being repaired. This small add-on is a true business-saver, preventing costly downtime and keeping your operations running without a hitch. And speaking of running smoothly, always ensure your carts are compliant with local laws. You can dive deeper into these requirements with our guide on golf cart registration.

To make it clearer, here’s a look at how these smart add-ons directly address common coverage gaps.

Common Exclusions vs Recommended Optional Coverage

| Common Exclusions (Typically Not Covered) | Recommended Endorsements (Optional Add-Ons) |

|---|---|

| Damage from racing or speed contests | Not available; this is a universal policy exclusion. |

| Normal wear and tear on parts | Not available; this is considered a maintenance cost. |

| Loss of value for custom modifications | Custom Equipment Coverage |

| Damage caused by an uninsured third party | Uninsured/Underinsured Motorist (UM/UIM) Coverage |

| Cost of a temporary cart during repairs | Rental Reimbursement Coverage |

By pairing a solid base policy with the right endorsements, you move from having just "insurance" to having a robust protection plan that truly works for you.

Answering Your Key Insurance Questions

Once you've got a handle on the basics of coverage and cost, the real-world questions start to bubble up. These are the practical, "what-if" scenarios that can make or break your decision. Let's dig into some of the most common questions we hear from business owners about commercial golf cart insurance.

Getting into the weeds of an insurance policy can feel a bit overwhelming. The trick is to get straight, simple answers that connect directly to how you run your business, so you're never caught off guard when you actually need to use your coverage.

Does My General Business Liability Policy Cover My Golf Carts?

Probably not. At least, not for anything that happens while it’s actually moving. Think of your General Liability policy as your "slip and fall" coverage—it’s there for when a customer gets hurt inside your building or has an issue with a product you sold.

But the moment a vehicle starts operating, a whole new set of risks comes into play. Insurers see a moving golf cart much like they see a car, which is why most general liability policies have a specific exclusion for vehicle-related accidents. Relying on it for a golf cart collision leaves a huge, potentially devastating gap in your protection.

What Is the Difference Between Actual Cash Value and Agreed Value?

This is a big one, and it really comes into focus if a cart is stolen or wrecked beyond repair (what the insurance world calls a "total loss"). How your policy values your cart determines the size of the check you get.

- Actual Cash Value (ACV): This is the default for most policies. It pays you what the cart was worth the second before the incident. ACV always accounts for depreciation, so a five-year-old cart is going to be worth a lot less than a brand-new one.

- Agreed Value: This is a much better deal. You and the insurer decide on the cart's value before the policy starts. If it gets totaled, you get that exact amount back. No arguments, no last-minute math, no depreciation.

For businesses running a fleet of high-end or heavily customized carts, an Agreed Value policy is almost always the way to go. It provides financial predictability when you need it most.

Understanding your payout structure is just as critical as the coverage itself. The gap between ACV and Agreed Value can easily be thousands of dollars—the difference between easily replacing a vehicle and scrambling to cover the shortfall.

Are My Employees Covered If They Are Injured While Driving?

This is a super common mix-up. If an employee gets hurt while driving a company golf cart on the job, their medical bills and lost wages fall under your Workers' Compensation insurance, not the cart's policy.

Workers' Comp is specifically designed for on-the-job employee injuries, period. The liability coverage on your commercial golf cart policy is meant to protect you from claims made by other people—like a guest, a vendor, or a member of the public who gets injured by one of your carts.

How Can I Lower My Commercial Golf Cart Insurance Premiums?

Good news! While you can't control everything that goes into your premium, you absolutely have the power to lower it. Insurers love to see proactive risk management, and they'll reward you for it.

Here are four of the most effective ways to earn a better rate:

- Implement a Formal Safety Program: This is the single best thing you can do. A documented training program for all operators shows you're serious about safety, which directly reduces the chance of an accident.

- Increase Your Deductibles: If you agree to pay more out-of-pocket for a physical damage claim (a higher deductible), your insurer will lower your premium. Just make sure you can comfortably cover that amount if something happens.

- Bundle Your Policies: Insurance carriers want more of your business. If you bundle your cart insurance with your general liability or commercial property policy, they’ll almost always give you a multi-policy discount.

- Install Safety Features: Ask your agent if you can get a rate reduction for adding things like seatbelts, headlights, horns, or speed governors to your carts. Every little bit helps demonstrate you're a lower-risk client.

Ready to protect your fleet with a vehicle that's as reliable as it is stylish? At Solana EV, we design premium, street-legal electric vehicles built for the demands of any commercial operation. Explore our models and discover a smarter way to move your business forward.

some truly interesting info , well written and loosely user pleasant.