If you've just brought home a new Solana EV, you're probably wondering about insurance. It's a common question: does it need the same kind of policy as my car? The short answer is yes, but it’s a specific type of policy.

Low speed vehicle insurance is a specialized policy built for vehicles that travel on public roads at speeds between 20-25 mph. It works a lot like standard car insurance, protecting you financially from liability and potential damages, but it's specifically designed for the unique risks and legal rules that come with owning an LSV. This coverage is not optional—it's a legal must-have in most places.

What Exactly Is Low Speed Vehicle Insurance?

Let's use an analogy. Think about the difference between a bicycle and a moped. A bicycle you ride on a private path might be covered for theft under your home insurance. But a moped, which you register to ride on public streets alongside other traffic, needs its own dedicated insurance policy. Your Solana EV is the moped in this scenario. It’s a street-legal vehicle, and that means it requires its own specialized protection.

This isn't just a friendly suggestion; it's the law. In the United States, if you want to drive your LSV on public roads, you have to insure it. Most states require LSVs to be registered, titled, and insured with at least the minimum liability coverage for both bodily injury and property damage.

It's a common misconception that other policies will cover you. Your standard homeowner's policy won't touch an incident that happens on a public street, and your regular auto insurance doesn't automatically extend to cover a separate LSV. You need a dedicated policy.

Understanding the Key Differences

To really get why this distinction is so important, it helps to see where an LSV fits into the larger world of vehicles. An LSV isn't a traditional golf cart you'd use on a private course. It shares the road with cars, trucks, and pedestrians, which introduces a completely different set of risks. If you want to dive deeper into what makes a vehicle an LSV, check out our guide on what a low speed vehicle is.

To help clarify these distinctions, let's compare an LSV side-by-side with a standard golf cart and a regular car.

LSV vs Other Vehicle Types at a Glance

| Characteristic | Low Speed Vehicle (LSV) | Standard Golf Cart | Standard Automobile |

|---|---|---|---|

| Top Speed | 20-25 mph | ~15 mph | 25+ mph |

| Street Legal | Yes, on roads with posted speed limits of 35 mph or less | No, typically restricted to private property | Yes, on most public roads |

| VIN Required | Yes, a 17-digit VIN is mandatory | No | Yes |

| Insurance | Specific LSV or auto policy required | Often covered under homeowner's insurance | Standard auto insurance required |

| Safety Features | Headlights, taillights, turn signals, mirrors, seatbelts | Minimal or none | Extensive (airbags, ABS, etc.) |

As you can see, the moment a vehicle is designed and permitted to operate on public roads—even at slower speeds—it steps into a whole new regulatory environment that demands proper insurance.

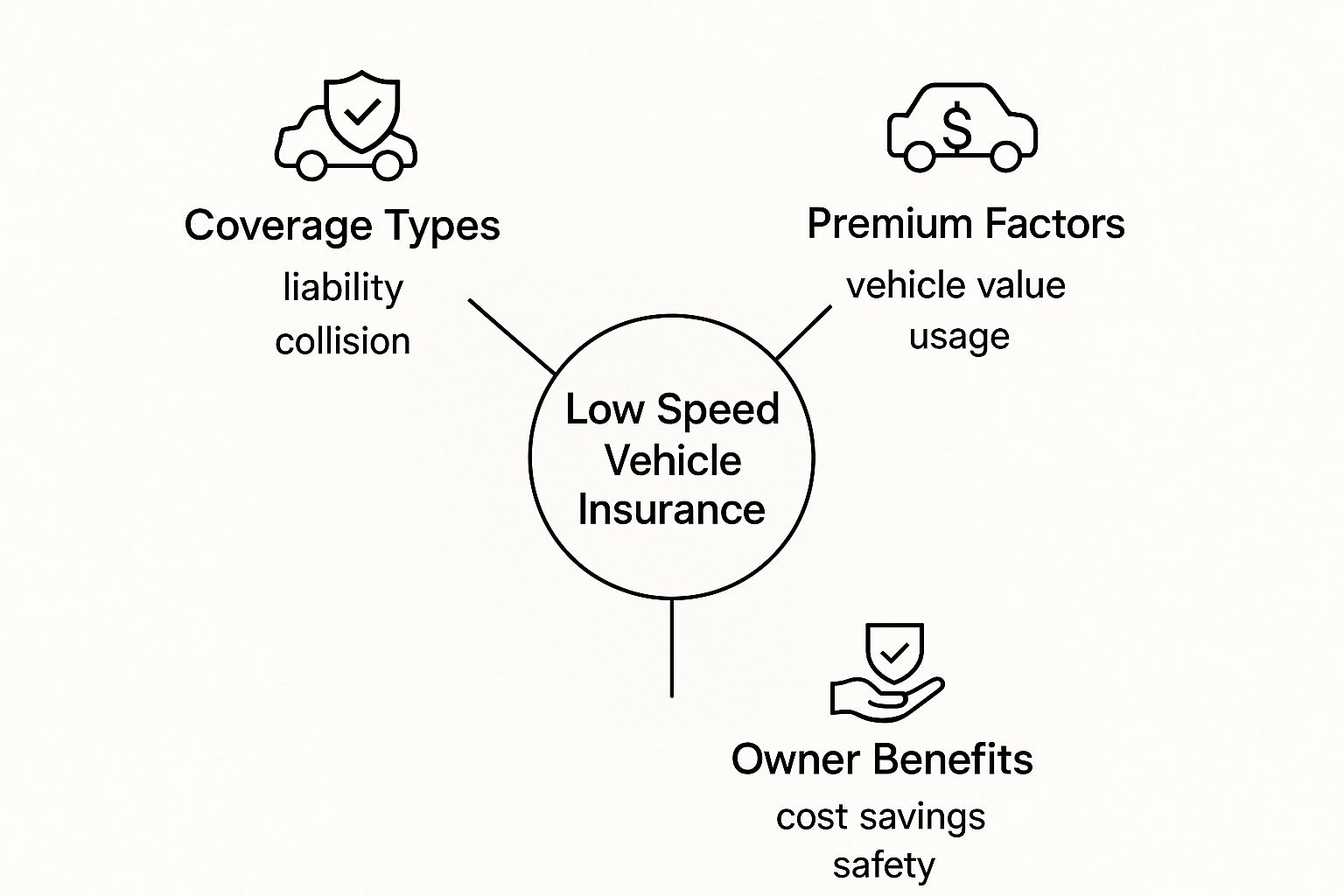

This image breaks down the essential parts of an LSV insurance policy, from the types of coverage available to the factors that influence your premium.

The takeaway here is simple: being street-legal comes with responsibilities. Securing the right insurance isn't just about following the rules; it's about giving yourself financial protection and peace of mind every time you take your Solana EV for a spin.

Navigating the Legal Maze of LSV Insurance

When you own a low-speed vehicle, you’re in a unique legal spot—somewhere between a standard golf cart and a regular car. This isn't just a minor detail; it’s a whole legal framework you need to understand to keep yourself protected and on the right side of the law. Think of it as a special set of rules just for your ride.

First things first, let's talk about registration and titling. Unlike the golf cart you might use on a private course, an LSV that drives on public roads has to be registered with your state's DMV. This is the same process a car goes through. It gets you a title and a license plate, making your LSV an officially recognized vehicle.

Understanding Mandatory Insurance Minimums

Once your LSV is registered, getting low speed vehicle insurance is the next critical step. Just about every state that allows LSVs on its roads requires them to have at least liability coverage. This isn't a "nice-to-have"—it's a must for driving legally.

This basic required coverage is split into two parts:

- Bodily Injury Liability: If you're at fault in an accident and someone gets hurt, this helps pay for their medical bills.

- Property Damage Liability: This covers the cost of repairing someone else's property, like their car or a fence, that you damaged.

So, if you accidentally tap another car in the grocery store parking lot, your property damage liability helps pay for their repairs. If the driver was injured, your bodily injury liability would kick in to help with their medical expenses.

Without this basic coverage, you'd be on the hook for those costs yourself, which could be financially devastating. It’s the fundamental safety net every LSV owner needs.

State and Local Laws Can Vary

Here's where it gets a little tricky. While federal rules define what an LSV is, the specific laws for insurance and driving are handled by each state—and sometimes even your city or county. What's required in Florida might be different from California, and some towns might have their own specific ordinances, like demanding higher liability limits than the state minimum.

Because of this, you absolutely have to check the regulations for your specific area. Your local DMV's website is the best place to start. For a complete picture, it's also a good idea to look at guides that break down the full street-legal golf cart requirements, since many of those rules overlap with LSVs. It's similar to how specialized vehicles have unique needs; understanding things like classic car insurance requirements can give you a better sense of how these policies work.

Don't be tempted to skip these steps. Driving an uninsured LSV can result in serious penalties, including big fines, a suspended driver's license, or even having your vehicle impounded. Worse, it leaves you personally exposed if you cause an accident. The laws are there to protect everyone on the road—and that includes you.

Choosing the Right Coverage for Your LSV

While state laws set the starting line for insurance, they don't cover the full race. Meeting the legal minimums is about protecting other people on the road, but what about protecting your investment and your own financial well-being? Building the right low speed vehicle insurance policy means creating a comprehensive shield that goes far beyond basic liability.

Think of it like this: liability insurance is the fire extinguisher for a fire you might cause in someone else’s house. It’s absolutely essential, but it won’t do a thing to help you rebuild your own. To protect your Solana EV from the unexpected, you need to add layers of coverage that truly fit your lifestyle.

Beyond Basic Liability: The Core Protections

Let's break down the most valuable types of optional coverage. These policies are designed to handle real-world situations, from minor mishaps to major incidents, ensuring you aren't left holding a hefty bill.

-

Collision Coverage: This is your go-to protection for physical damage to your LSV if you're in an accident. Let's say you misjudge a turn in a tight parking garage and scrape your vehicle against a pillar. Collision coverage is what helps pay for those repairs, minus your deductible. It’s for any incident where you collide with another vehicle or an object.

-

Comprehensive Coverage: This policy handles almost everything else. Think of it as the "life happens" coverage for damage from non-collision events like theft, vandalism, a falling tree branch during a storm, or even a rogue shopping cart denting your side panel. If your LSV is stolen from your driveway, comprehensive coverage is what helps you replace it.

These two coverages work hand-in-hand to protect the actual value of your vehicle. And considering the soaring popularity and value of LSVs, this protection is more critical than ever. The global low-speed vehicle market is projected to grow from an estimated USD 11.98 billion in 2025 to USD 21.63 billion by 2032.

Guarding Against the Uninsured

One of the smartest additions you can make to your policy is Uninsured/Underinsured Motorist (UM/UIM) coverage. This vital protection steps in when you're in an accident caused by a driver who either has no insurance or not enough to cover your expenses.

Without UM/UIM coverage, you could be stuck paying for your own medical bills and vehicle repairs if you're hit by an irresponsible driver. It’s a crucial safety net in a world where, unfortunately, not everyone follows the rules.

When you're building out a policy for your LSV, it can be helpful to look at how other niche vehicles are handled. There are often specialized vehicle insurance requirements, like those for classic cars, and understanding these parallels can give you a better sense of what you might need.

Finally, think about your specific use case. Do you carry passengers often? Have you added custom accessories? Talking through these details with an insurance agent will help tailor your policy perfectly. Even your initial choice between an electric or gas-powered cart can influence long-term costs. The goal isn't just to be legally compliant—it's to craft a policy that delivers genuine peace of mind.

Key Factors That Influence Your Insurance Rate

Ever gotten an insurance quote and wondered how they landed on that specific number? It's not random. Insurers are essentially risk assessors, and your premium is a direct reflection of how much risk they believe you and your LSV represent.

Think of it like a puzzle. Each piece—your driving history, your zip code, the vehicle itself—helps form the final picture of your rate. Knowing what those pieces are gives you the power to influence the outcome. You can’t change your age, but other factors are definitely in your control.

A spotless driving record tells an insurer you're a responsible driver. On the other hand, a history of tickets or accidents flags you as a higher risk, which naturally leads to a higher premium for your low speed vehicle insurance.

This isn't just about you, though; it's part of a massive global market. The entire vehicle insurance sector, which includes LSVs, was valued at around USD 910.51 billion in 2024 and is only expected to grow. You can dive deeper into these trends by checking out this detailed vehicle insurance market report.

Your Vehicle and Location

The specific Solana EV model you drive is a huge piece of the puzzle. Just like with standard cars, a more expensive or powerful model typically costs more to insure. Why? Because the potential repair or replacement costs are higher. Any custom parts or fancy accessories you've added will also bump up its value and, in turn, your premium.

Where you live and park your LSV matters just as much. Insurance companies have a ton of data on local theft, vandalism, and accident rates.

- High-Risk Areas: If you're in a zip code with a reputation for vehicle theft, your rates will likely be higher to account for that increased risk.

- Secure Storage: Keeping your LSV in a locked garage versus an open carport can often earn you a nice little discount. It’s simple—a secure vehicle is less likely to be stolen or damaged.

Your Personal Profile and Choices

Finally, your personal details and the coverage you choose lock in the final rate. Insurers will look at things like your age and driving experience, as statistics show that more seasoned drivers tend to have fewer accidents.

The biggest variable you control is the policy you build. A bare-bones, liability-only policy will always be the cheapest option. But adding comprehensive and collision coverage, while it does increase the premium, offers critical protection for your investment.

Your deductible plays a big role, too. A higher deductible—the amount you agree to pay out-of-pocket before the insurance company steps in—almost always means a lower premium. It's a classic trade-off between your monthly payment and how much you'd have to shell out if something happens.

Understanding these factors is the key to not just getting a policy, but getting the right policy at the best possible price. The table below breaks down the most important variables at a glance.

Key Factors Influencing Your LSV Insurance Premium

This table highlights the main variables that insurance companies consider when calculating the cost of a low speed vehicle insurance policy.

| Factor | Why It Matters | How to Potentially Lower Your Cost |

|---|---|---|

| Driving Record | A history of accidents or violations signals higher risk to insurers. | Drive safely, obey traffic laws, and consider a defensive driving course. |

| Location (ZIP Code) | Rates are higher in areas with more theft, vandalism, or accidents. | Store your LSV in a secure, locked garage to mitigate location-based risks. |

| Vehicle Model & Value | More expensive vehicles cost more to repair or replace after a claim. | Choose a model with a good safety record and lower repair costs. |

| Coverage Types | More coverage (e.g., collision, comprehensive) means a higher premium. | Select only the coverage you truly need, but don't leave yourself underinsured. |

| Deductible Amount | This is your out-of-pocket cost per claim. | Opt for a higher deductible if you can comfortably afford it in an emergency. |

| Driver's Age & Experience | Younger, less experienced drivers are statistically riskier. | Maintain a clean record over time; some insurers offer student discounts. |

By focusing on the elements you can control, like your driving habits and policy choices, you can actively work to keep your insurance costs reasonable.

Finding the Best LSV Insurance Policy

Shopping for low speed vehicle insurance shouldn't be a headache. With the right approach, you can land a policy that gives you solid protection without draining your wallet. It really just boils down to a bit of prep work and smart comparison shopping.

Think of it like getting ready for a road trip. You wouldn't just jump in the car and start driving, right? You’d check your map and make sure you have what you need. Finding insurance works the same way—a few key details upfront make the whole process faster and more accurate.

Get Your Ducks in a Row Before You Quote

Before you even think about calling an agent or filling out an online form, get all your information together. This one simple step will save you a ton of time and frustration later and helps ensure the quotes you get are the real deal.

Here’s what you’ll almost always need:

- Vehicle Identification Number (VIN): The unique 17-digit code for your Solana EV.

- Driver Details: Grab the driver's license numbers for anyone who will be behind the wheel.

- Storage Address: Where will the LSV be parked? Your zip code is a major factor in determining your rates.

- Coverage Goals: Think about what you need. Are you looking for the bare-bones liability required by law, or do you want full coverage that includes collision and comprehensive protection?

Walking into the conversation with these details ready shows insurers you’re serious and helps them give you a precise quote, not just a ballpark guess. This is your foundation for a successful search.

Shop Around and Compare with a Plan

Once your info is organized, it's time to start shopping. The biggest mistake you can make is taking the very first offer you get. Your goal should be to gather at least three to five different quotes. This is the only way to get a real feel for the market and what a competitive price actually looks like.

Cast a wide net. Check with specialty insurers that focus on LSVs and golf carts, but don't forget to call the major carriers you might already use for your car or home. Big companies often give great discounts for bundling policies, which can lead to some serious savings.

Comparing quotes isn't just about the bottom-line price. Dig into the details. Look closely at the coverage limits and deductibles on each option. That super-cheap premium might look great until you realize it comes with a sky-high deductible or dangerously low liability limits that could leave you on the hook financially after an accident.

Ask the Right Questions to Unlock Discounts

This is where you can really make a difference in your final premium. When you're talking to an agent, you have to be your own advocate. Don't be shy about asking for discounts—many aren't applied automatically.

Make sure you ask about savings for things like:

- Bundling Policies: Do you get a price break for bringing your home or regular auto insurance over?

- Safety Features: Be sure to mention any anti-theft devices or other safety upgrades on your Solana EV.

- A Clean Driving Record: This is one of your best bargaining chips. If you're a good driver, make sure they know it.

- Paid-in-Full Option: Many insurers will knock a percentage off your premium if you pay for the whole year upfront.

Talking to a knowledgeable agent—whether they're a niche specialist or with a major carrier—can be a game-changer. They know the ins and outs of different policies and can help you spot hidden savings, making sure your low speed vehicle insurance is the perfect fit for your needs.

Answering Your Top LSV Insurance Questions

Diving into low speed vehicle insurance for the first time? You've probably got questions. That's a good thing. Getting smart about your coverage is the best way to protect your investment and yourself. Let’s tackle some of the most common questions we hear from LSV owners.

Will My Homeowners Insurance Cover My LSV?

This is a big one, and the answer is almost always a firm no. Your homeowners policy might offer a sliver of coverage for a standard golf cart that never leaves your yard, but that’s where it ends.

The moment your Solana EV gets a title and license plate, it becomes a street-legal vehicle. Legally, it needs its own auto-style insurance policy, just like your car. Trying to rely on your homeowners policy for a vehicle you drive on public roads is a recipe for disaster, leaving you completely exposed if an accident happens.

What's the Ballpark Cost for Low Speed Vehicle Insurance?

Nailing down one "average" price is tough because so many things can change the final number. That said, for a basic liability-only policy, you can generally expect to see prices starting in the $75 to $150 per year range. Think of that as your floor, not the final quote.

What really shapes your premium?

- Your driving history: A clean record always pays off with lower rates.

- Where you live: Insurance costs more in areas with heavy traffic or higher theft rates.

- Your LSV's value: A top-of-the-line model costs more to protect than a basic one.

- The coverage you choose: Adding comprehensive and collision is a must to protect your investment, and it will raise your premium accordingly.

The only way to know for sure is to get quotes from a few different insurance companies and compare them.

Don't make the classic mistake of just picking the cheapest plan. You have to look at the coverage limits and deductibles to make sure you're getting real protection, not just a low price tag.

Do I Need a Different Policy if I Rent Out My LSV?

Yes, without a doubt. This is a deal-breaker. A personal low speed vehicle insurance policy is for your use only. It provides zero coverage the second you start using your LSV for any commercial purpose, and that includes renting it out.

If you’re planning to rent your LSV—even just as part of a vacation home package—you need a commercial insurance policy. These policies are built to handle the higher risks that come with rentals. If a renter has an accident, a commercial policy protects your business; a personal policy would deny the claim in a heartbeat. Be upfront with your insurer about your plans to make sure you have the right coverage.

Can I Save Money by Bundling My LSV Insurance?

You bet. Most insurance carriers love to give discounts to customers who bring them more business. If you already have your car, home, or renters insurance with a company, asking if they cover LSVs is your best first move.

Bundling is one of the simplest ways to knock down your total insurance bill. It keeps all your policies in one place and can lead to some serious savings. Just remember to ask for the discount specifically—don't assume it will be added on its own.

Ready to experience the future of personal transportation? The lineup of Solana EV vehicles combines luxury, performance, and sustainability for the ultimate driving experience. Explore our models and find the perfect ride for your lifestyle at https://solanaev.com.

Hello my family member! I want to say that this post is amazing, great written and come with almost all significant infos. I would like to look more posts like this. http://www.kayswell.com

Wow, fantastic blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is great, let alone the content!

I do agree with all of the concepts you’ve introducedon your post. They’re really convincing and will definitely work.Nonetheless, the posts are very brief for newbies.May just you please extend them a bit from subsequent time?Thanks for the post.

I’ve been surfing online more than 3 hours today, yet I never found any interesting article like yours. It抯 pretty worth enough for me. In my view, if all website owners and bloggers made good content as you did, the internet will be much more useful than ever before.

Great info.